I was delighted to attend ScotChain 16, the first Scottish Blockchain conference at RBS. The afternoon brought together everyone from academia and industry with an interest in Blockchain technology. Students, in their final years or at the beginning of PhD’s, were looking for inspiration. Government advisers were trying to understand what Blockchain could mean for the economy. Start-up founders were hoping to see what it meant for their future. Just like me, everybody was there to discover as much as they could.

Here is my take on the afternoon and how the technology means the real digitisation of value, not just information.

Blockchain Technology

Just like computers enabled the digitisation of information, Blockchain enables the digitisation of value. Blockchain technology at its crux is a distributed database. It is a platform for representing and exchanging ‘things of value’. These ‘things of value’ can be anything from song lyrics to personal information. As Blockchain is shared it is a single reliable version of the truth. This means that information is correct and always accessible.

In the first talk of the afternoon Kent Mackenzie, Director at Deloitte, reiterated this point. He defined it as a distributed database that is: public, scalable and always synchronised.

Applications of Blockchain – the ‘Blocktopus’

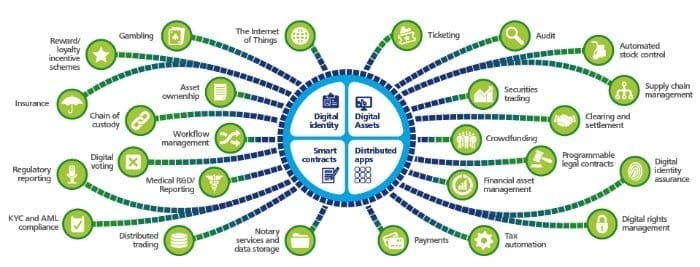

Scepticism of Blockchain having worthwhile applications out with the handling of digital currencies has hindered its uptake. However, Deloitte’s ‘Blocktopus’ displays well just how many use cases it really has. The ‘Blocktopus’ identified use cases in 4 main areas:

- Digital Identity (personal information)

- Smart Contracts (digital contracts)

- Digital Assets (any digital files)

- Distributed Apps (software run on multiple computers).

One use case which grabbed my attention used Blockchain to store personal information. The Blockchain would store one single representation of an individual’s details accessible from anywhere. The information stored proves your identity (e.g. place of birth, address, etc.). Having one single trusted identity erases conflicts and duplication. Conflicts arise when people own many accounts storing contrasting attributes.

For example, addresses change over time so which one’s correct? Masses of conflicting information from numerous sources shades doubt over what to believe. This is an issue for banks when looking to grant mortgages. The benefit of switching to this technology would mean there exists one trustable version of information. This version can be relied upon by organisations when confirming people’s correct identity.

Deloitte Case Study

Ross Laurie, Consultant in the Blockchain Lab at Deloitte, contextualised how Blockchain can improve security of personal information. His example based itself around trying to buy beer in a bar.

The scenario goes that bartenders ask customers for ID to prove their age. Customers would then perhaps hand over driving licenses or passports. The ID would display other personal information: name(s), address, place of birth, etc. Information irrelevant to whether the customers are over 18.

In fact, all the bartender needs to know is that the customer is old enough to purchase alcohol. Here the customer would present proof of their age stored on the Blockchain. The proof would come from governing bodies (e.g. passport office, DVLA) confirming the attributes of an individual. Here bartenders would only need to know the DVLA have confirmed the customer is over 18.

Deloitte have developed an open source system to demonstrate this use case.

Use cases will grow with more time spent investigating and testing its capabilities. However, it is important to not see Blockchain as the solution to every business problem. Tom McCann and Maria Khan, Innovation Team at The Royal Bank of Scotland, expressed their philosophy towards it.

If a database can do it, then don’t use Blockchain.

They follow this philosophy because Blockchain doesn’t need to replace every system they use. For now, until more people are using the technology it isn’t as effective.

Drawbacks

Technology must be sustainable for industries out with the financial sector to want to adopt it. With modern technologies expected to last longer and longer the Blockchain needs to do the same. For now, perhaps too many of those outside industries are watching to see what happens within the financial sector. The financial sector is one of the few that have money and resources to fund research. For others, the barriers to progress are where Blockchain projects aren’t the priority. They are waiting to see the outcomes of current research before making their move.

The Potential of Blockchain

Bruce Pon, CEO at BigChainDB, estimated that Blockchain will impact $100 trillion in value to the economy. However, as exclaimed by Tom McCann (Innovation Scout at the Royal Bank of Scotland) “There is only so much fun you can have on your own in the Blockchain”. To push this technology forward, research needs to be done collectively.

The buzzword of the day was very much collaboration. Collaboration between competitors will be required to truly explore the applications and benefits across sectors.

Further Reading

- Satoshi Nakamoto’s Peer to Peer Research Paper

- UK Government Blockchain report

- Deloitte’s Smart Identity Concept